LIKE HAVING 150 BANKS WORKING FOR YOU AT ONCE!

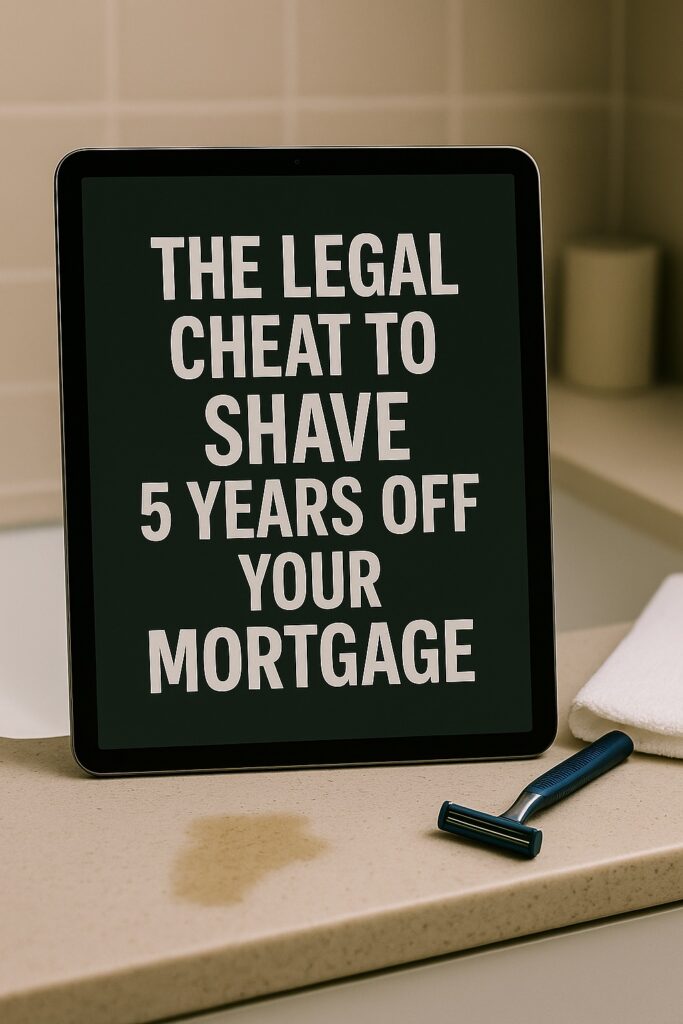

"TOP MORTGAGE BROKER GIVING AWAY HIS SECRET STRATEGY TO SHAVE 5+ YEARS OF MORTGAGE PAYMENTS STARTING TODAY"

The Ultimate CHEAT CODE To Save Money On Interest, And Be Mortgage Free Faster.So You Can Sit On Your Butt, Worry Free!

Learn The Strategy only the Wealthiest canadian's use For FREE Now!

5.0

391 Over All Platforms

LENDERS THAT LOVE US! (WE THINK....)

“IF THESE GUY’S TRUST US, SO SHOULD YOU!” OUR LENDERS GIVE US HEAVY DISCOUNT ON MORTGAGE RATES

LIST OF GENIUS PEOPLE

"REAL PEOPLE"

THAT BEAT THE BANKS

Our clients are pre-approved within 4 business hours. Speed is key to getting the best deals on real estate.

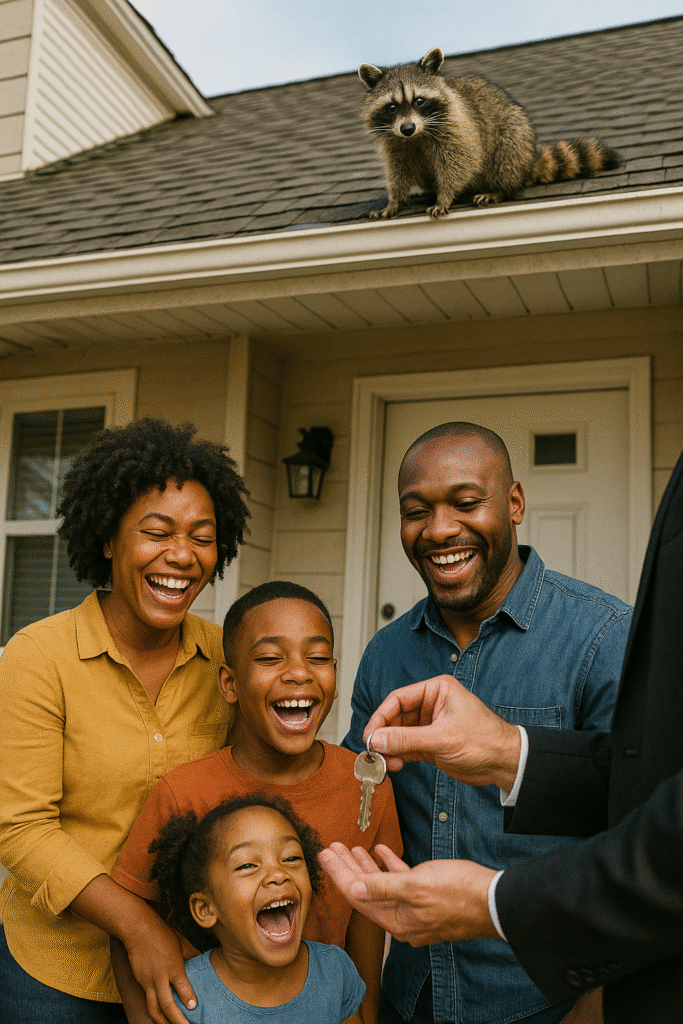

Happy customers who are now living in their dream homes!

Smart people that are getting mortgages, with the best terms, conditions and rates!

Get a Mortgage Without the B.S

Why Canadians Choose US?

Faster approvals

You have timelines, like condition date. We care when your bank does not!

LOWER RATES

Our rates cannot be beat!

NO BOTS

Actually talk to a real person! We return calls within 2 business hours, if we are busy

Terms and conditions

Some lenders sneak non beneficial features into your mortgage to lock you in. We help you prevent it.

CHAT GPT SAYS

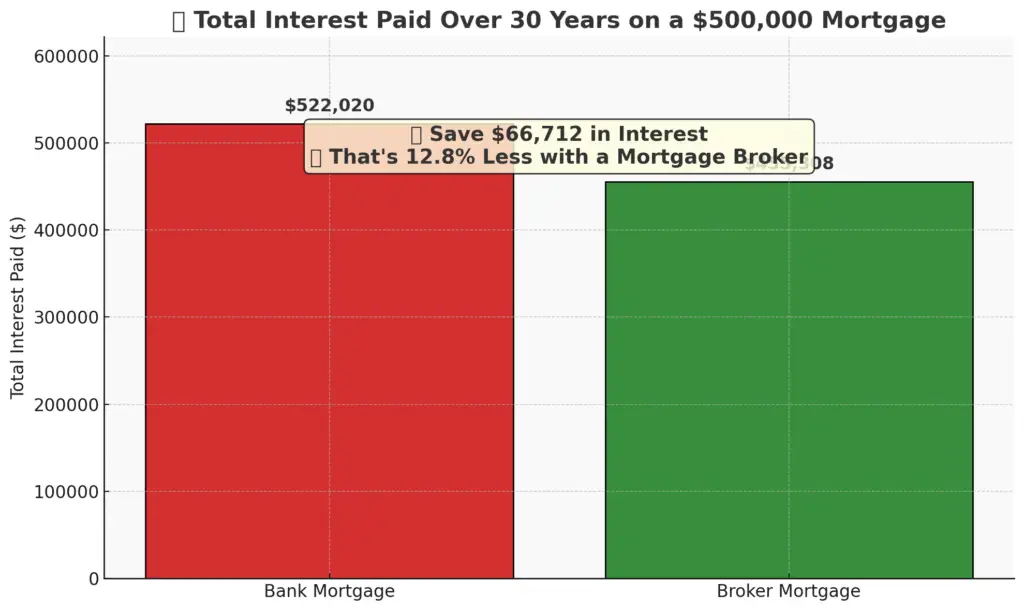

SAVE Money on interest!

$66, 000!!!

OMG

our Products

Low Cost Mortgage

The banks give us huge discounts on rates! We negotiate with them to ensure you get the craziest rates, you can brag to your friends about.

EZ Approvals

We are the easiest place to get approved for a mortgage. We approved hundreds of people every year that have been declined by other lenders

Private & "B" Mortgages

We Shop every private lender to find you the best terms and conditions. Get approved now at the lowest rates in Canada.

Mortgage Refinance

Refinance to pay out debt, or just to get a better rate.

HERE IS WHAT OUR CLIENTS SAY

Sean And Radika were patient and took the time to answer all of our questions. They made getting a mortgage easy!.....

P.Coomar

First Time Buyer

Sean got us approved in 2 days after our bank was taking forever to get us approved. We almost lost our house! Thank you for your fast work!.....

Jared Anderson

New Home buyer

Radika and the team are very professional and organized. I will be using them from now on, and I recommend you all do the same!

Sean Jackson

Mortgage Refinance

Sean and his team absolutely saved our deal!!! We were buying a vacation property and my broker was having issues getting us approved.....

Steve Lozeron

REALTOR

WORK WITH US

Sean and Radika assisted my family in getting their first mortgage in Canada. We dealt with another broker before and did not get the service we needed to buy our first home......

Keisha P

First Time Buyer

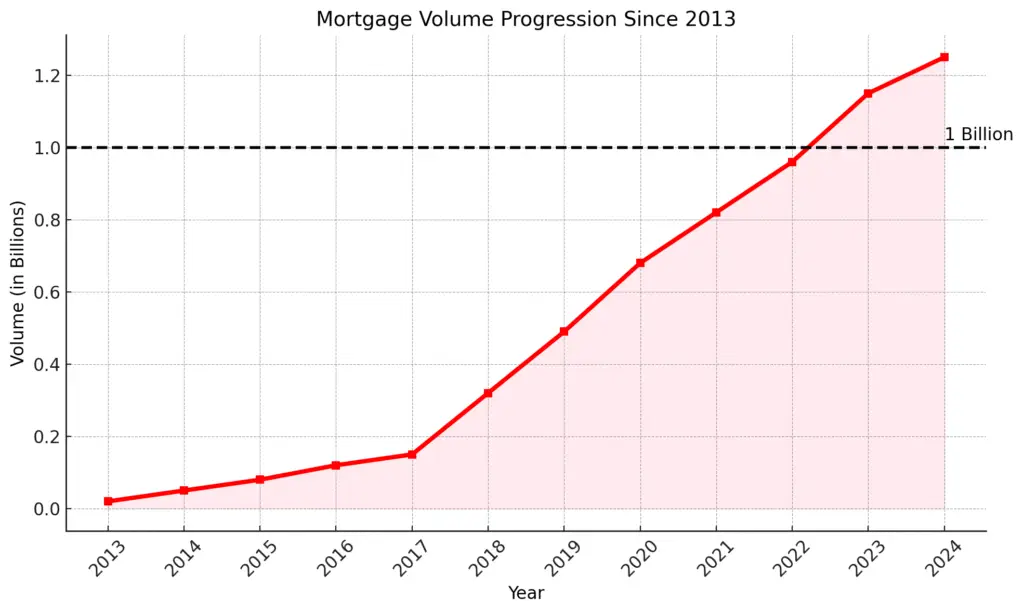

Our Clients Are "Saving More Money, And Paying Their Mortgages Off Faster" than They Would At A Bank!

Have you ever felt like you were just a number to the bank? Or that you were not getting the attention you deserve?

Many People get this kind of treatment, and it is NOT ACCEPTABLE!

That’s is what I am trying to CHANGE.

We give every single person, the attention they need to achieve their mortgage goals. Not matter your gender, colour, or opinions.

GUARANTEES

LOWER RATES

Our Rates Are Lower Than Banks and Other Brokers.

Top Level Service

Our Team Cares about Your Goals, That’s Why We Are One Of The Most Refered Mortgage Team

Every Option Attempted

We try every Lender Until We Get An Approval.

More Lenders

We Access More Lenders than other Brokerages, Leading To Way More Approvals!

REAL ESTATE COMPANIES

COMPANIES WE ALREADY WORK WITH ON A DAILY BASIS, THAT TRUST US.

NEW TO CANADA MORTGAGES

CASH-BACK MORTGAGE

Percentage of Business

EXCLUSIVE PROGRAMS

main features

- Easy Approvals

- Fast Closing

- Appraisal Discounts

- High Communication

- Lower Rates

- Free Estimates

- Savage Negotiation

- Legal Discounts

- Interest Savings

- New To Canada Program

- Builder Draw Mortgages

- First TIme Home Buyers

- Incentive

- BGRS Military Program

- First Responders Program

- Doctors and Nurse Mortgage Program

- No Credit/Bad Credit Repair Program

- Realtor Mortgage Specialist Program

- Trade Worker Program

- No Downpayment/Flex Down Program

- Cash Back Program

YOUR MORTGAGE TEAM

3 Highly Experienced Mortgage Brokers working for you=APPROVED

Our perfect mortgage clients

HOW DO WE GET

The lowest rates?

More lenders to negotiate rates with than any other brokerage in Canada!

More brokers=More Volume. Banks give us discounts on rates because of the volume sent in.

Combined we have spent over 100,000 hours negotiating with banks.

FAQ

ask us

anything

How Long Does It Take to get approved for a mortgage?

It takes 1 business day to be pre approved for a mortgage.

Is it better to use a mortgage broker or go directly to a bank?

In most cases, a mortgage broker gives you more options and better rates than going to one bank. Brokers aren’t tied to a single lender, so they shop around for you. Plus, they can help get deals approved that banks might decline.

Do mortgage brokers charge fees in Canada?

Usually no for regular mortgages. Brokers get paid by the lender. But in complex cases like private mortgages or commercial deals, there may be a broker fee, which they’ll disclose upfront.

Can mortgage brokers get better rates than the bank?

Yes. Brokers often have access to volume discounts and broker-only rates not available at bank branches. They’re also more flexible in finding custom solutions.

How much can I afford to borrow?

This depends on your income, debts, credit score, and down payment. A mortgage broker can pre-qualify you in minutes to show your budget range based on lender guidelines.

What’s the minimum down payment in Canada?

5% for homes under $500,000

10% on the portion over $500K, up to $1 million

20% required for homes over $1 million or investment properties

Can I get a mortgage if I’m self-employed or have inconsistent income?

Yes—but not always from a big bank. Brokers have access to alternative lenders and “stated income” programs designed for business owners, gig workers, and freelancers.

What’s the difference between fixed and variable rates?

Fixed: Locked-in rate and payment for the term (e.g., 5 years).

Variable: Lower initial rate, but it can change with the market.

Your broker can break down which is better based on current trends and your risk tolerance.

Can I get a mortgage with bad credit?

Yes, but likely not through a major bank. A broker can connect you with B-lenders or private lenders who look at the whole picture, not just your credit score.

What documents do I need to apply for a mortgage?

Typically:

Government-issued ID

Income proof (pay stubs, NOAs)

Bank statements

Employment letter

List of debts and assets

Brokers help you prep and package everything correctly to avoid delays.

What’s a pre-approval and why should I get one?

A mortgage pre-approval tells you how much you can borrow and locks in your interest rate (usually for 90-120 days). It makes you a stronger buyer and prevents surprises later.

Can new immigrants get a mortgage in Canada?

Yes. There are special New to Canada programs that allow newcomers to buy with as little as 5% down. Brokers can help you qualify even if you haven’t built a full credit history yet.

What happens if my mortgage application is denied by a bank?

All hope isn’t lost. Brokers have access to many other lenders. A bank saying “no” doesn’t mean you’re out of options.

Why should I use a mortgage broker instead of just Googling lenders myself?

Better rates

Access to exclusive offers

Faster approvals

More lender options (including ones not online)

Personal guidance with paperwork, strategy, and negotiating

Google won’t call a lender on your behalf or fight to get your deal approved. A broker will.